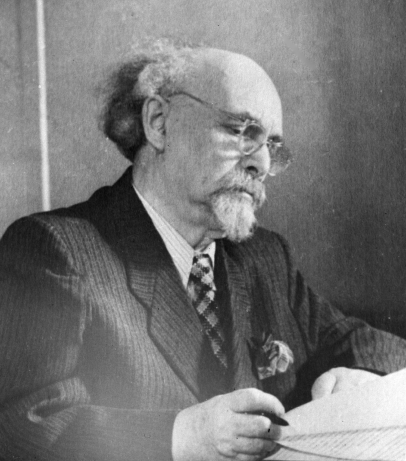

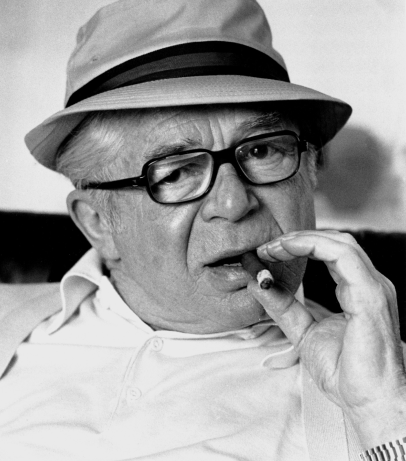

On 14 July 1946, the US Senate, after a heated debate, approved a loan of $3.75 billion to the United Kingdom. The loan was negotiated by British economist John Maynard Keynes shortly before his death and US Under Secretary of State for Economic Affairs William Clayton. The agreement stipulated that the loan would be given at 2% interest, with $1.19 billion being provided by Canada on the same terms.

The UK economy was crippled by the war - about 55% of GDP was oriented towards war production, and export earnings plummeted. For a long time, Britain had been importing basic consumer goods and food, but in 1945 it was no longer able to pay for them. The situation became particularly harsh after 21 August 1945, when the United States ended shipments under the Lend-Lease programme. Britain was virtually on the brink of bankruptcy.

The loan demanded convertibility of the pound sterling, and after the ratification of the loan on 15 July 1947, within a month the exporting countries would receive nearly a billion dollars in payment for goods from British reserves. The Cabinet would eventually be forced to suspend exchangeability and drastically reduce domestic and foreign spending. In 1949, the pound would be devalued from $4.02 to $2.80.

The bulk of the proceeds would go towards military expenditures in the outlying colonies. According to Keynes, failure to implement the loan agreement would result in the abandonment of British military outposts in the Middle East, Asia, and the Mediterranean, as a decline in British living standards was politically impossible.

The loan would be repaid on 29 December 2006 with a payment of $83 million to the US and $23.6 million to Canada. Following these payments, Ed Balls, Britain's economic secretary to the Treasury, would officially thank the US for its wartime support.

Source:

“The Anglo-American Loan of 1946: U.S. Economic Opportunism and the Start of the Cold War”, Callaway, C. Darden (2014)